Nigeria’s apex banking regulator and its deposit insurer have pledged deeper collaboration to safeguard financial stability as the Central Bank of Nigeria (CBN) accelerates its landmark banking recapitalisation programme and navigates volatile macroeconomic headwinds.

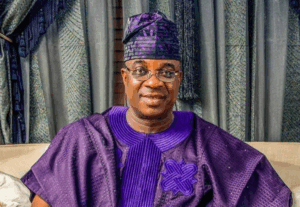

CBN Governor Olayemi Cardoso, hosting the newly appointed management of the Nigeria Deposit Insurance Corporation (NDIC) at the bank’s headquarters in Abuja, said the visit underscored the urgency of building a coordinated response to systemic risks in the financial sector.

He congratulated NDIC’s new Managing Director and Chief Executive, Thompson O. Sunday, and his team, stressing that the evolving economic landscape required tighter inter-agency synergy to protect depositors and maintain confidence in the banking system.

“Our meeting today is a clear testament to our willingness to work together,” Cardoso said. “The CBN counts on NDIC’s support in navigating the uncertain times that we are in.”

He added that lessons from his two years in office had highlighted the need for modern risk-monitoring tools to anticipate potential shocks and ensure resilience.

Sunday, in his remarks, hailed the CBN’s reforms, citing the stabilisation of the foreign exchange market and the recapitalisation of Deposit Money Banks as critical steps toward restoring investor confidence.

He revealed that NDIC is undergoing a strategic restructuring aligned with its revised mandate under the NDIC Act 2023 and is preparing a new corporate strategy to replace its current plan, which expires at the end of the year.

The NDIC chief detailed recent milestones, including the payment of N54.62 billion to 691,418 depositors of the defunct Heritage Bank and the declaration of a 9.2 kobo per Naira liquidation dividend to uninsured depositors within a year of the bank’s closure, an unprecedented payout speed in Nigeria’s banking history.

He also highlighted ongoing efforts to develop a target funding framework to strengthen NDIC’s intervention capacity during future bank resolutions.

Sunday flagged gaps such as the absence of a unique identifier like the Bank Verification Number (BVN) for corporate customers and challenges in premium collection from insured institutions without CBN accounts, urging collaborative solutions.

He also called for the creation of a joint crisis preparedness framework to improve systemic response.

Responding, CBN Director of Financial Policy and Regulation, Rita Sike, said the proposal would be addressed under the Financial Services Regulation Coordinating Committee (FSRCC) and disclosed ongoing upgrades to the Credit Risk Management System (CRMS) to integrate the Global Standing Instruction (GSI) and onboard Other Financial Institutions — a move expected to strengthen credit risk oversight.

The meeting comes as Nigerian banks intensify efforts to raise fresh capital to meet the CBN’s new capital thresholds, a process analysts say will test market depth and investor appetite. Coordinated oversight by the CBN and NDIC is seen as critical to ensuring depositor protection and preventing contagion risks during the recapitalisation drive.