N54.9tn Budget: FG, World Bank at Odds Over Funding Strategy

The Federal Government and the World Bank are at loggerheads over the viability of Nigeria’s record N54.99tn 2025 budget, with the Bretton Woods institution warning that the revenue targets may not be realistic, potentially forcing the government to resort to borrowing from the Central Bank of Nigeria.

The World Bank, during its Nigeria Development Update (NDU) presentation in Abuja on Monday, described the budget as “overly ambitious,” citing concerns over key assumptions such as oil production and pricing benchmarks, which it said are unlikely to be achieved.

President Bola Tinubu had earlier signed the 2025 Appropriation Act—the highest in Nigeria’s history—following its upward revision from N49.7tn to N54.99tn. The budget earmarks N13.64tn for recurrent spending, N23.96tn for capital projects, N14.32tn for debt servicing, and N3.65tn for statutory transfers. It projects a fiscal deficit of N13.08tn, expected to be financed through both domestic and external borrowing.

Speaking at the report launch, the World Bank’s Lead Economist for Nigeria, Alex Sienaert, said Nigeria’s revenue expectations remain uncertain, despite improved collections in 2024. He expressed doubt over budget assumptions such as a daily crude oil production of 2.06 million barrels and an oil price of $75 per barrel, pointing out that current output hovers around 1.6 million barrels per day.

He warned that if the budget’s ambitious revenue targets fall short, Nigeria might be compelled to turn to the CBN’s Ways and Means facility—an overdraft mechanism the government had previously pledged to avoid.

“If revenue targets are not met, the financing requirements will increase beyond budgeted levels,” Sienaert cautioned. “That raises the risk of arrears or renewed deficit monetisation, which would undermine macroeconomic stability and confidence in the naira.”

The World Bank also urged the Federal Government to eliminate the electricity subsidy, which it labelled “wasteful and regressive,” and called for deeper reforms to protect fiscal gains achieved through the removal of the petrol subsidy and a more flexible exchange rate regime.

Other recommendations included improving oil revenue transparency, cutting the cost of governance, and ramping up investments in education and healthcare—sectors where Nigeria spends just 1.2% and 1.8% of GDP, respectively.

On inflation, Sienaert said monetary policy reforms had curbed some pressures, but the cost of living remained high, with recent changes to the Consumer Price Index complicating the analysis of current trends.

He also called for the accelerated rollout of the federal cash transfer programme to cushion reform-related hardships for poor households, noting that only one-third of the 15 million targeted beneficiaries had received support so far.

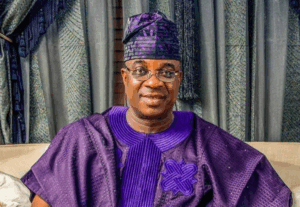

In contrast, the Minister of Budget and Economic Planning, Senator Abubakar Bagudu, rejected the World Bank’s assessment, insisting that the budget projections are “modest” and aligned with Nigeria’s growth potential.

“Is the projection ambitious? No, they are not,” Bagudu said. “They are all modest. We’ve produced over 2.3 million barrels of oil per day in the past, and our budget is based on $73 oil—which is realistic given our premium grades.”

He emphasized that the Tinubu administration was focused on unlocking Nigeria’s economic potential, revealing plans to map opportunities across the country’s 8,809 political wards to drive grassroots development.

Bagudu further argued that Nigeria’s revenue and expenditure-to-GDP ratios had improved, boosting fiscal space for sub-national governments. He attributed poverty data to pre-existing conditions, urging citizens to see current reforms as solutions, not setbacks.

Also speaking, Minister of Finance and Coordinating Minister of the Economy, Wale Edun, acknowledged gains since mid-2023 but said greater fiscal transparency—especially in oil revenues—remains crucial. He disclosed ongoing collaboration with revenue-generating agencies and the CBN to improve data consistency.

The event concluded with key stakeholders from federal and sub-national governments and the private sector reaffirming their commitment to Nigeria’s reform agenda, expressing optimism that current policies would steer the country toward macroeconomic stability and a $1tn economy by 2030.