Deremi Atanda: How Wema Bank became the pillar of fintech innovation in Africa

Deremi Atanda: How Wema Bank became the pillar of fintech innovation in Africa

…celebrates eight decades of trust, technology, and transformation

Fintech, the fusion of finance and technology, has democratised access to financial tools once limited to urban elites. From mobile payments to online lending, fintech platforms empower businesses, improve livelihoods, and lift millions into formal economic structures.

It has also transitioned from a peripheral trend into the mainstream engine driving financial services across Nigeria in the last decade. This technological evolution, fueled by smartphones, internet access, and innovative policy frameworks, redefines banking in Africa’s largest economy.

A World Bank report highlights this potential, stating, “Nigeria’s fintech sector holds the potential to bridge financial inclusion gaps using mobile money, digital payment platforms and wallets as a leverage to reach underserved populations in rural and remote areas.”

According to a 2022 McKinsey report, Africa’s financial services market is on course to grow at 10% annually, reaching approximately $230 billion in revenues by 2025. Nigeria stands at the epicenter of this explosion, accounting for nearly one-third of the continent’s fintech market. Yet, the challenge remains stark as over 50% of Nigeria’s adult population remains unbanked or underbanked.

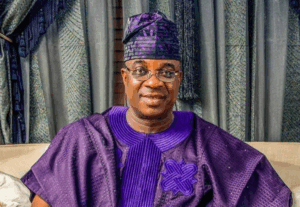

This is where financial institutions like Wema Bank are quietly reshaping the economic landscape. As the oldest Indigenous bank in Nigeria, Wema’s transformation journey is compelling and instructive. At the heart of this reinvention stands a partnership with Remita Payment Services Limited (RPSL), led by Managing Director Deremi Atanda.

A legacy rooted in innovation

Founded in 1945 as Agbonmagbe Bank, Wema Bank has spent eight decades navigating Nigeria’s volatile financial terrain. Surviving colonialism, military rule, and digital disruption, the bank’s endurance is evidence of its strategic vision and willingness to evolve.

For Deremi Atanda, the connection with Wema Bank is as professional as personal. “Before I was MD of Remita, I was a Wema Bank customer,” Atanda said in an interview. “I’ve held a Wema Bank account since entering the corporate world and it has been a part of my financial life for years. Watching the bank evolve, digitise, and expand its offerings over time, all while remaining accessible and reliable, brings a certain level of familiarity, consistency, and reliability.”

That early customer experience laid the groundwork for a deep, strategic partnership.

As fintech took off in the mid-2010s, Wema didn’t resist the tide. Instead, it chose to surf the wave. “They weren’t just trying to keep up,” Atanda said. “They were creating the blueprint.”

The birth of ALAT, Africa’s first fully digital bank

In 2017, Wema Bank took a bold leap that would set its future and redefine the Nigerian banking experience. The launch of ALAT, Africa’s first fully digital bank, was a watershed moment in the continent’s financial history, marking a clear break from the constraints of traditional banking systems.

Many viewed such a pivot as high risk for a bank that had been in operation for over 70 years. But for Wema Bank, it was a calculated move grounded in foresight, customer behavior trends, and the growing demand for accessible, mobile-first financial solutions.

“ALAT was not an experiment but a statement,” Atanda said. “It proved that innovation doesn’t have to come from startups alone. Legacy institutions can lead too if they are willing to rethink their models.”

What set ALAT apart was not just the technology but the user-first design philosophy behind it. Nigerians can now open a bank account in less than five minutes, using only their BVN (bank verification number) and phone number, without visiting a physical branch. From the comfort of their mobile devices, users gained access to a full suite of services, including savings accounts, loans, virtual cards, fixed deposits, bill payments, and even lifestyle features like automated savings goals.

For a population where over 40% of adults were financially excluded as of 2016, this level of accessibility was groundbreaking. The success was immediate and measurable.

In its first year, ALAT attracted over 250,000 users, processed over ₦1.6 billion in deposits, and quickly became Nigeria’s digital banking benchmark. But Wema wasn’t content to stop there. The platform scaled rapidly with continuous iteration and upgrades driven by customer feedback and data analytics.

In a demonstration of its growing digital dominance, Wema Bank recorded a remarkable surge in earnings from its electronic banking platforms, generating ₦6.1 billion in revenue in 2022 alone. This performance reflects a substantial growth trajectory, a 79% increase compared to the ₦3.5 billion the bank posted in 2021 from the same channels. This leap shows the bank’s strategic push towards digital transformation and highlights the growing acceptance of its fintech offerings, particularly ALAT, Africa’s pioneering fully digital banking platform.

The sharp rise in revenue was fueled by an innovative onboarding strategy, which saw thousands of new customers adopt ALAT for their day-to-day financial transactions. By 2023, ALAT had become more than just a banking app. It had evolved into a full-fledged digital ecosystem.

The platform had onboarded over 574,000 active users, reflecting a broad user base that cuts across Nigeria’s youth, small business owners, and underserved communities seeking convenience and flexibility in managing their finances.

Moreover, ALAT’s transactional volume exceeded ₦1 trillion in value, a milestone that signals deep user engagement and trust in its capacity to securely handle high-value and high-volume transactions. Whether bill payments, savings automation, or digital lending, ALAT’s functionality proved robust and adaptable to Nigeria’s rapidly evolving financial landscape.

The platform also had strong financial fundamentals. In Q1 2023 alone, ALAT recorded a net income of ₦886 million, representing a 6% increase over the previous quarter and a 28% year-on-year growth, figures that underline its growing contribution to Wema Bank’s bottom line.

But beyond the numbers, ALAT sparked a more profound change in industry attitudes. No longer was digital banking an optional channel; it became the standard.

“ALAT showed us that banks don’t need to look or feel like banks,” Atanda added. “The future is digital-first, customer-focused, and always-on, and Wema Bank led that charge before it became fashionable.”

Wema Bank also used ALAT to target underserved youth and entrepreneurial segments, offering features like micro-loans, savings incentives, and SME-friendly digital products.

As of 2024, ALAT is expanding its footprint beyond individual banking. Plans are underway to evolve the platform into an enterprise and embedded finance solution, offering APIs for startups, integrating e-commerce payment infrastructure, and driving agency banking in rural locations. This vision aligns with Wema Bank’s larger strategy of becoming a platform institution that enables, empowers, and embeds financial services across sectors.

Today, nearly every Nigerian bank has followed Wema’s digital footsteps. But ALAT will always be remembered as the pioneer that started it all, built not by a startup but by a legacy bank with the courage to innovate ahead of the curve.

Financial Inclusion: From Buzzword to Blueprint

Beyond its digital façade, Wema Bank’s most significant achievement may be its grassroots impact. Financial inclusion has long been a development goal in Nigeria. Yet, it is often pursued through top-down policies with limited reach. Wema Bank took a different approach.

“They rolled up their sleeves and entered communities,” the MD said. “They launched products and taught people how to use them.”

Agent banking became the cornerstone of this effort. In remote towns, rural markets, and underserved regions, Wema set up touchpoints where people could deposit, withdraw, and manage funds. But it didn’t stop there.

Wema ran financial literacy campaigns, educating traders, artisans, and farmers on budgeting, saving, and using mobile wallets. Market women, previously dependent on cash, started transacting digitally.

“Financial literacy is more than just opening accounts, the MD continued. “It is also about enabling agency, helping people plan, protect, and prosper.”

This commitment to inclusion has translated into loyalty. Rural customers who were once disconnected now see Wema as an enabler, not just a service provider.

Trusting Tech: The Remita-Wema Collaboration

At the heart of Wema Bank’s tech revolution lies a fruitful partnership with Remita Payment Services Limited. Led by Atanda, Remita facilitates billions of naira in transactions monthly, from payroll to tax remittances.

Given the nature of both businesses, which are focused on seamless digital payments and financial technology infrastructure, the synergy between Remita services and Wema Bank’s progressive, tech-driven banking approach was both immediate and essential, according to the MD.

“Wema did more than provide banking services, they stood out as our natural and strategic partner” he said. “They became a foundational part of our operations and a key enabler in our mission to simplify payments for businesses and individuals alike.”

One major project between the two firms was deploying a payroll management system for Wema Bank. “Through one of our other subsidiaries, we had the opportunity to deploy a payroll management software solution tailored for the bank’s internal use,” Atanda stated. “That experience was significant because it showed the bank’s trust and confidence in our expertise.”

Today, Remita and Wema co-create systems that power SMEs, government disbursements, educational institutions, and healthcare organisations.

Gratitude and the Road Ahead

As Wema Bank marks its 80th anniversary, the institution is looking firmly toward the future with an ambition beyond traditional banking. Rather than simply celebrating a milestone, Wema’s leadership is steering the bank toward becoming a full-fledged platform institution.

“Wema is proof that you can be 80 years old and still lead a revolution,” Atanda said. “On behalf of everyone at Remita, I want to congratulate Wema Bank. Eighty years is extraordinary but what you’ve done with those years is even more remarkable.”

As Nigeria’s fintech journey unfolds, Wema Bank stands tall as a resilient, visionary, and profoundly human pillar. For Atanda and countless others, this is more than a corporate story. It is a story of trust, growth, and technology’s limitless potential. “This isn’t the end of their journey,” he said. “It’s the beginning of their legacy.”