UBA targets global expansion, innovation with N239bn rights issue

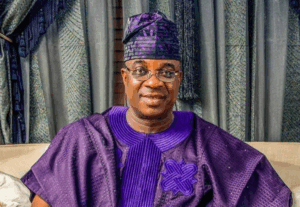

Group chairman, UBA, Mr. Tony Elumelu, said the primary objective of the ongoing rights issue is to strengthen the bank’s position as a pan-African banking industry leader and a highly rewarding institution for all stakeholders.

He said, the group decided on the rights issue to ensure that shareholders continue to derive undiluted benefits from a stronger, more innovative and resilient pan-African banking group.

Elumelu said, the rights issue would enable the bank to drive organic expansion and business growth within and outside Nigeria, while strengthening its international operations, adding that UBA recently signed agreement to commence full banking operations in France.

According to him, with presence in key global financial hubs including United Kingdom (UK), United States of America (USA), France and United Arab Emirates (UAE), the bank would deepen its global operations by investing more in these global markets and further extend its global reach.

He noted that, “with African subsidiaries contributing more than 50 per cent of the group’s overall performance, the bank would also make additional investments in existing African operations while exploring new opportunities. UBA currently has operations in 19 African countries outside of Nigeria.”

He pointed out that the bank’s expansion plan is driven by its philosophy of developing African businesses, noting that with UBA is not only expanding its geographical reach, but also playing a strategic and pivotal role in the economic transformation of Africa as a continent.

He added that while the rights issue would enable the bank to meet the new capital requirements stipulated by the Central Bank of Nigeria (CBN), the net proceeds would put the bank in a better stead to expand lending to small and medium enterprises (SMEs).

He outlined that the bank would make substantial additional investments in technologies to consolidate its reputation as a cutting-edge financial services group and deliver more robust customer experience.

To him, new investments in information and communication technology (ICT) would further strengthen the group’s digitization and operational efficiency, thus fostering improving oordination and synchronisation amongst the various entities and delivering improved service delivery and customer satisfaction.