FCMB Group posts N91.8bn profit, records 67% growth in 9 months

FCMB Group Plc has announced a remarkable 67 per cent increase in Profit Before Tax (PBT), reaching N91.8 billion for the nine months ended 30 September 2024.

This achievement underscores the Group’s robust financial and operational performance across its business segments.

Gross revenue surged by 67.2 per cent year-on-year to N587.8 billion, up from N351.5 billion in the same period of 2023. This growth was driven by an 86.5 per cent rise in interest income and a 26.2 per cent increase in non-interest income.

Net interest income grew by 44.3 per cent to N173.8 billion, supported by improved yields on earning assets, which rose from 14.9 per cent to 17.4 per cent.

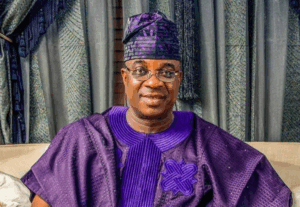

Ladi Balogun, Group Chief Executive of FCMB Group, attributed the strong performance to sustained growth across all four business divisions. “We expect to maintain this momentum as we continue our transformative capital-raising programme. Improved interest margins, significant balance sheet growth, and better efficiency ratios will further strengthen our position.

These efforts will enable us to accelerate our purpose-led strategy in supporting the Nigerian and broader African economies,” Balogun said.

Operating expenses increased by 51.7 per cent to N169.1 billion, reflecting higher personnel, regulatory, and inflation-driven costs. Despite this, the cost-to-income ratio remained efficient at 55.4 per cent. Net impairment losses on financial assets declined by 22 per cent to N44.4 billion, reducing the cost of risk to 2.7 per cent from 3.9 per cent in the previous year.

The Group’s PBT growth was well-balanced across its divisions, with Nigerian banking operations contributing 68 per cent, while other operating companies accounted for 32 per cent. Year-on-year earnings growth was recorded across Consumer Finance (108.5 per cent), Investment Banking (63.3 per cent), Banking Group (49.8 per cent), and Investment Management (31.4 per cent).

FCMB’s total assets grew significantly by 75.9 per cent to N6.82 trillion, while loans and advances increased by 58.9 per cent to N2.53 trillion. Customer deposits rose by 71.1 per cent to N4.33 trillion, and assets under management expanded by 36 per cent to N1.30 trillion.

The Group’s customer base grew by 15.2 per cent to 13.9 million, with its agency banking network expanding to over 362,000 agents, adding more than 700,000 new customers.

Despite challenges in the debt capital markets due to high interest rates, the Investment Banking Division mobilised N876 billion in capital for clients, compared to N691 billion in the previous year. Additionally, the Group successfully launched and completed the first phase of its capital-raising programme.